Take Control of Your Money with a Simple Plan That Fits Your Life

Start with clear, straightforward guidance—no jargon, no pressure—just real steps to build financial confidence and security.

Why It Feels Like No Matter What You Do, You Can’t Get Ahead

You work hard, but it feels like your money is always slipping through your fingers. Debt grows faster than your income, bills pile up, and just when you think you’re getting ahead, an unexpected expense sends you right back to square one.

It’s no surprise you avoid checking your bank account—it can feel stressful or even scary. You want to make smart choices, but the advice feels confusing or out of reach. You’re left wondering who you can trust—and how you’ll ever build real security.

The Real Reason You’re Struggling With Money

It’s not about earning more or trying harder—it’s about knowing exactly where you stand, what to focus on, and having a step-by-step plan built around your life.

Without that clear foundation, it’s easy to feel stuck in the same cycle, unsure which move will actually help. When you get the right guidance and a simple roadmap, everything changes.

You don’t have to figure this out alone—or all at once. There’s a way forward that feels manageable, confident, and real.

You’re Not Alone—Here’s The Financial Reality for Most Canadian Families in 2025

Overleveraged Households

Nearly 40% of Canadian families report carrying high levels of debt relative to their income, including mortgages, credit cards, and consumer loans.

(Source: Equifax Canada Consumer Debt Index, 2024)

Rapid Rising Cost of Living

Despite rising incomes, 60% of Canadians say their expenses have grown just as fast or faster, making it hard to save consistently.

(Source: RBC Canadian Financial Health Index, 2024)

Anxiety & Avoidance

Studies show that 1 in 3 Canadians avoid looking at their bank accounts regularly because it causes stress or anxiety. This “ostrich effect” leads to poor money management decisions.

(Source: TD Bank Financial Wellness Report, 2023)

Lack of Financial Education

Over 70% of Canadians admit they don’t feel confident making major financial decisions without professional help, yet many don’t fully understand the advice they receive.

(Source: Canadian Foundation for Economic Education, 2024)

Considerable Planning Gaps

Only about 35% of Canadian families have a written financial plan or retirement strategy in place, leaving many unprepared for unexpected expenses or long-term goals.

(Source: Investors Group Report on Financial Preparedness, 2024)

How we do things differently

We walk with you—not ahead of you, not behind you—so you never feel lost in the process. Yes, we’re advisors. But we’re also parents, partners, and people who’ve been where you are. We don’t expect you to trust us right away.

We just ask that you start with a conversation—and see the difference for yourself.

You’re Not Alone—Here’s The Financial Reality for Most Canadian Families in 2025

Overleveraged Households

Nearly 40% of Canadian families report carrying high levels of debt relative to their income, including mortgages, credit cards, and consumer loans.

(Source: Equifax Canada Consumer Debt Index, 2024)

Rapid Rising Cost of Living

Despite rising incomes, 60% of Canadians say their expenses have grown just as fast or faster, making it hard to save consistently.

(Source: RBC Canadian Financial Health Index, 2024)

Anxiety & Avoidance

Studies show that 1 in 3 Canadians avoid looking at their bank accounts regularly because it causes stress or anxiety. This “ostrich effect” leads to poor money management decisions.

(Source: TD Bank Financial Wellness Report, 2023)

Lacking Financial Literacy

Over 70% of Canadians admit they don’t feel confident making major financial decisions without professional help, yet many don’t fully understand the advice they receive.

(Source: Canadian Foundation for Economic Education, 2024)

Considerable Planning Gaps

Only about 35% of Canadian families have a written financial plan or retirement strategy in place, leaving many unprepared for unexpected expenses or long-term goals.

(Source: Investors Group Report on Financial Preparedness, 2024)

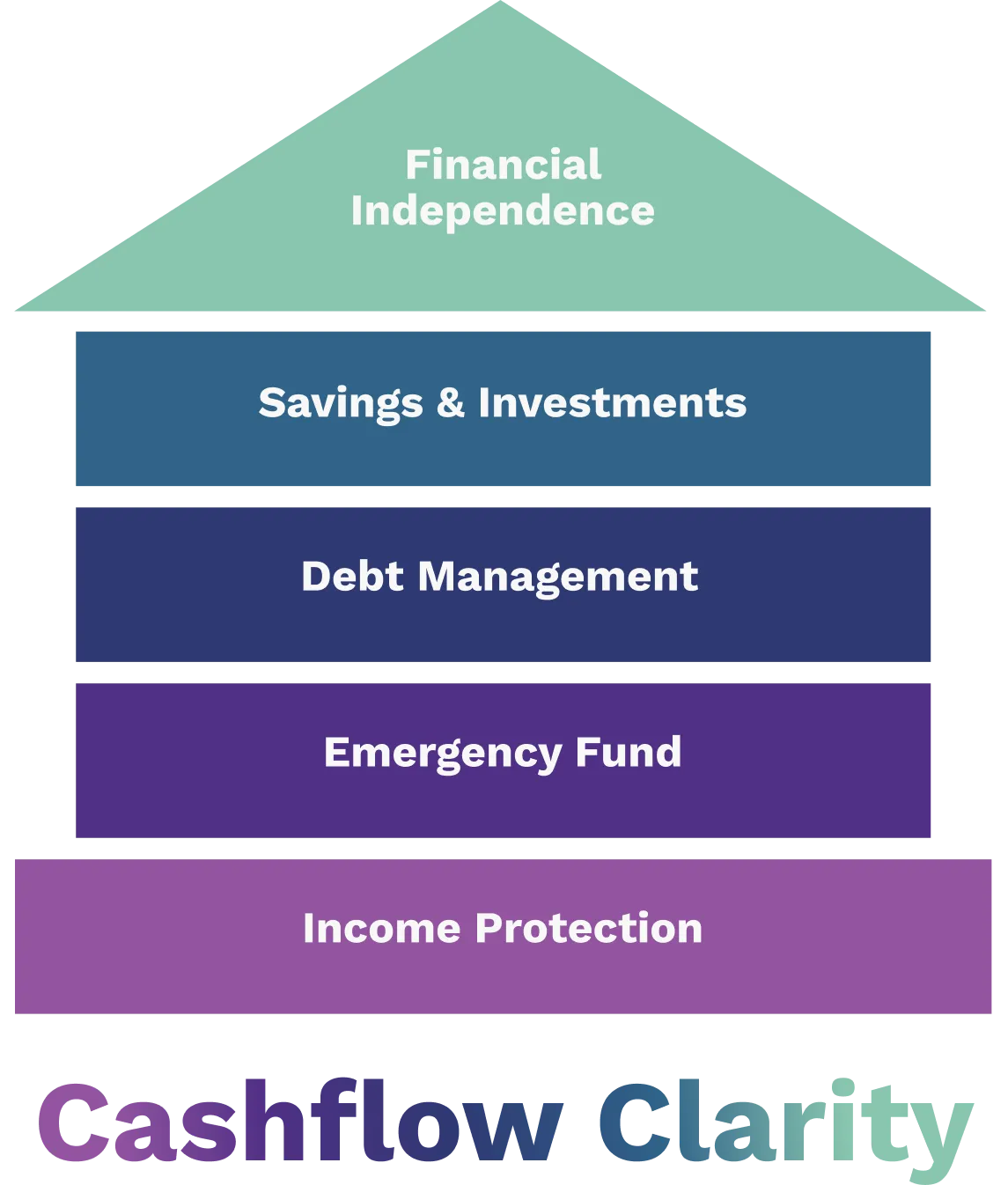

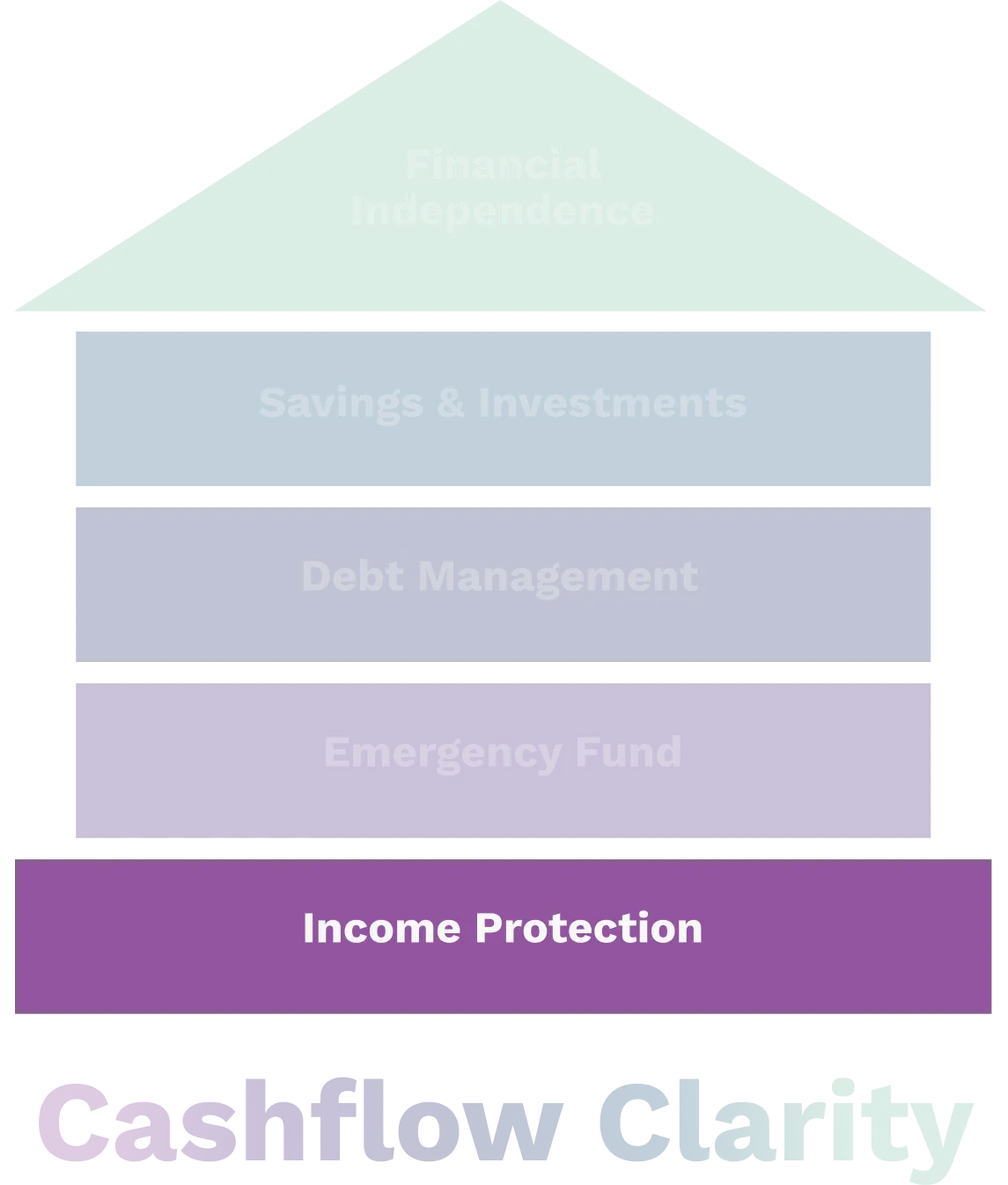

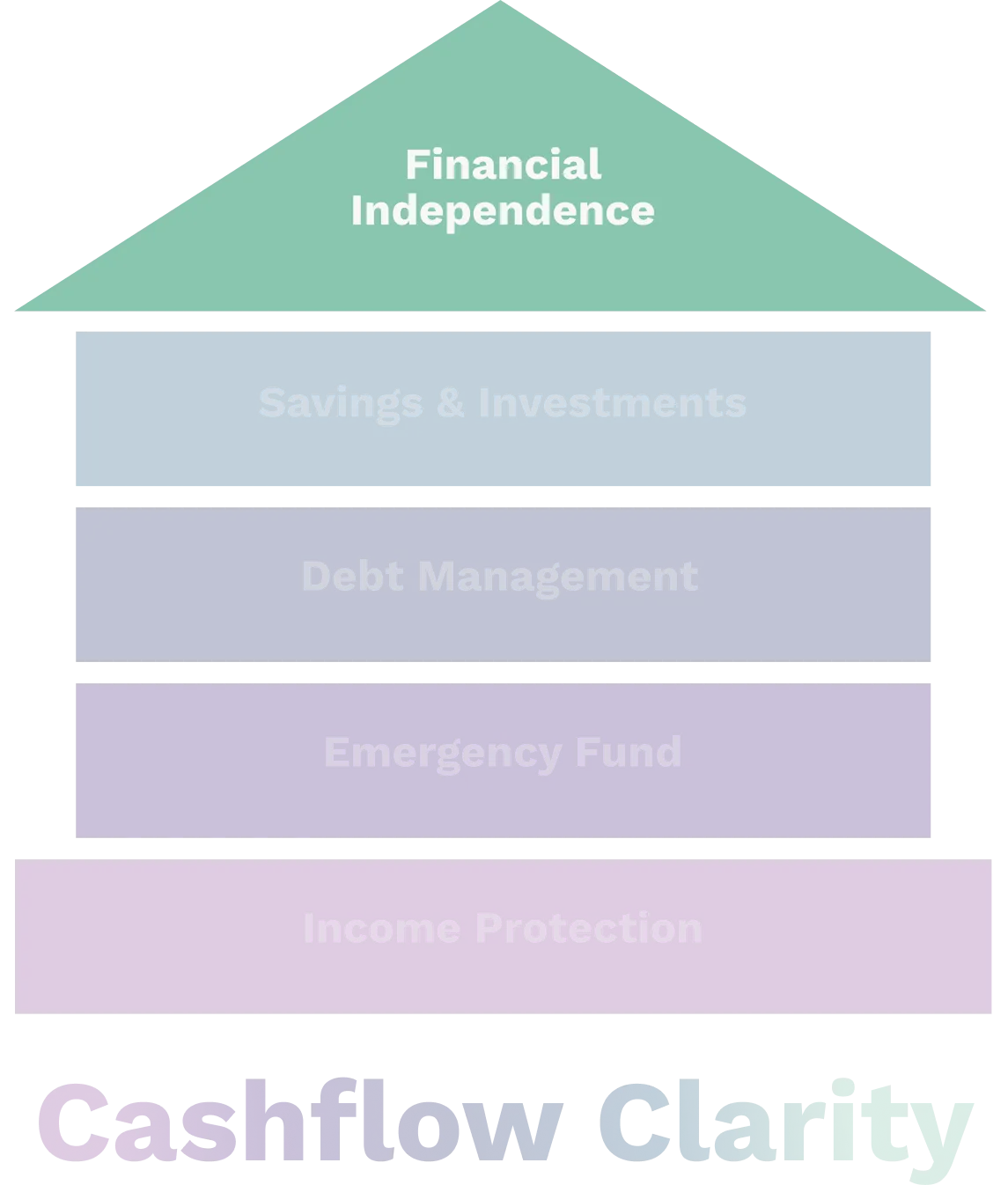

step by step

Building Your Financial House

Cashflow Clarity

Before you build anything, you need solid ground.

If you don’t know where your money’s going, it will always feel like there’s “never enough.”

We help you get clear on your income, your spending, and your patterns—so you can make decisions with confidence instead of confusion.

The Ground

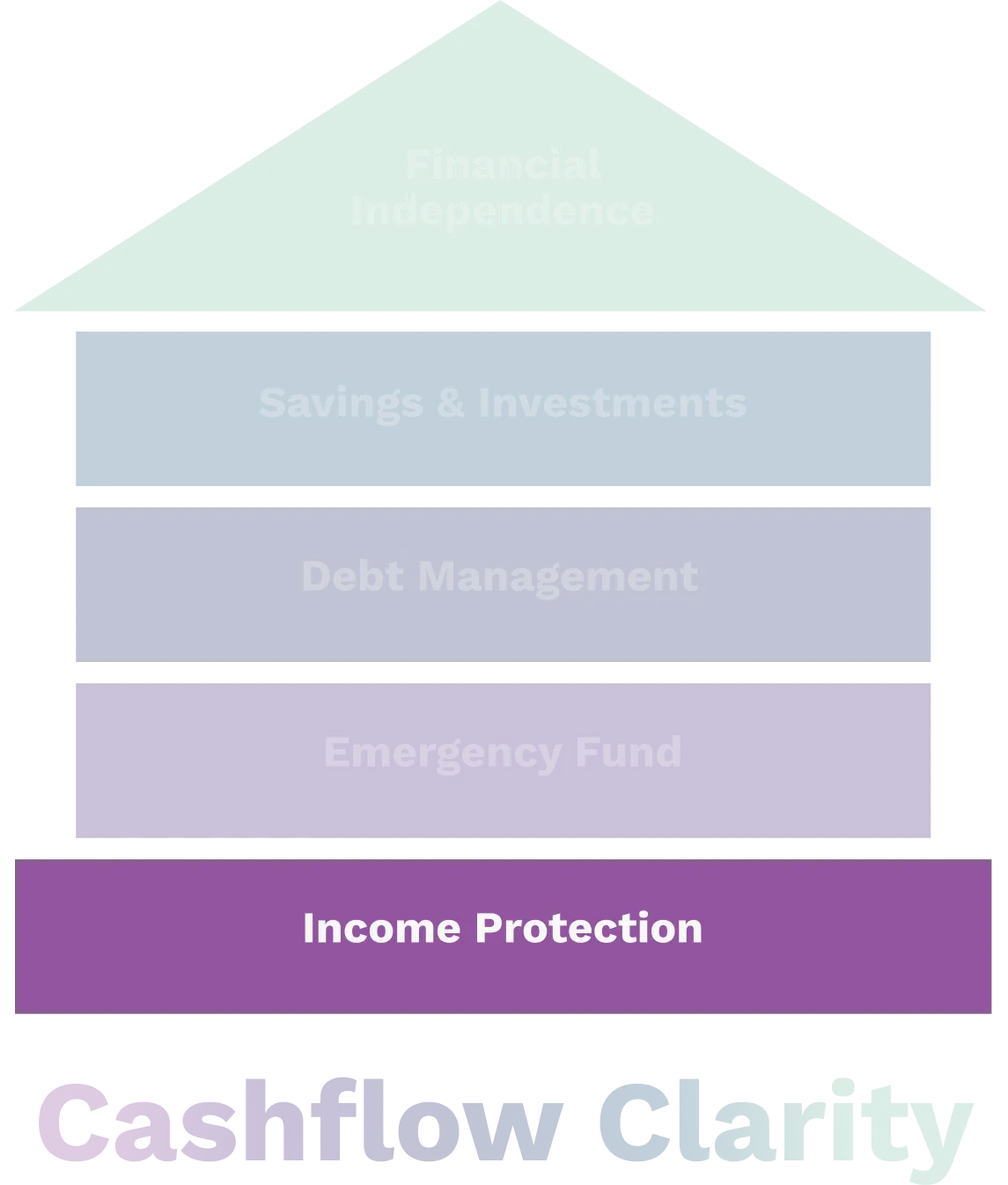

Income Protection

If your income stopped tomorrow, what would happen?

Your ability to earn is what everything else depends on.

We help you secure the right protection so your entire financial life doesn’t collapse from a single unexpected event.

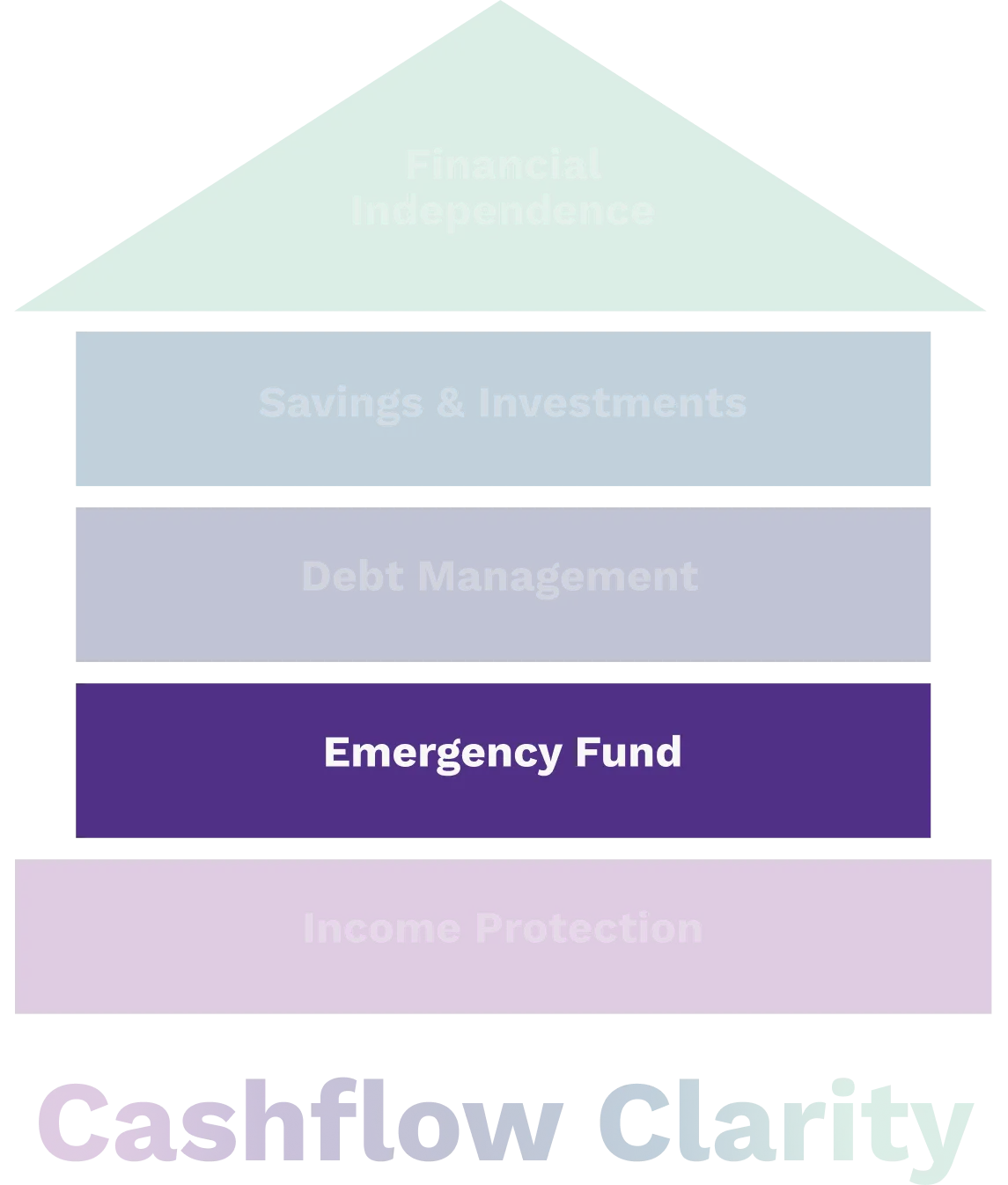

The Foundation

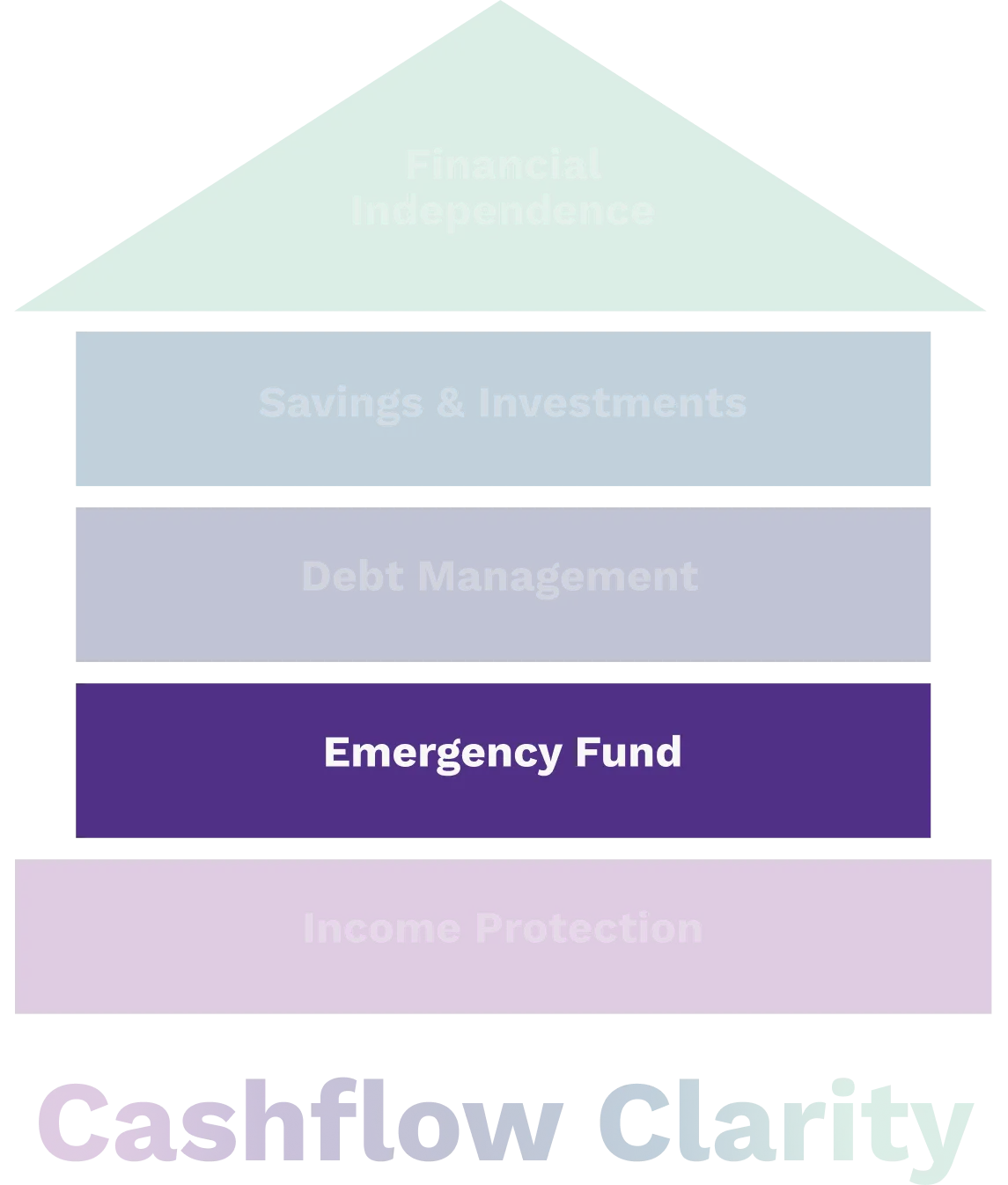

Emergency Fund

Emergencies are not “if.” They’re “when.”

When you don’t have a buffer, every curveball becomes a crisis.

We help you build a safety net that makes space for real life—without panic, guilt, or relying on borrowing and credit cards.

The Basement

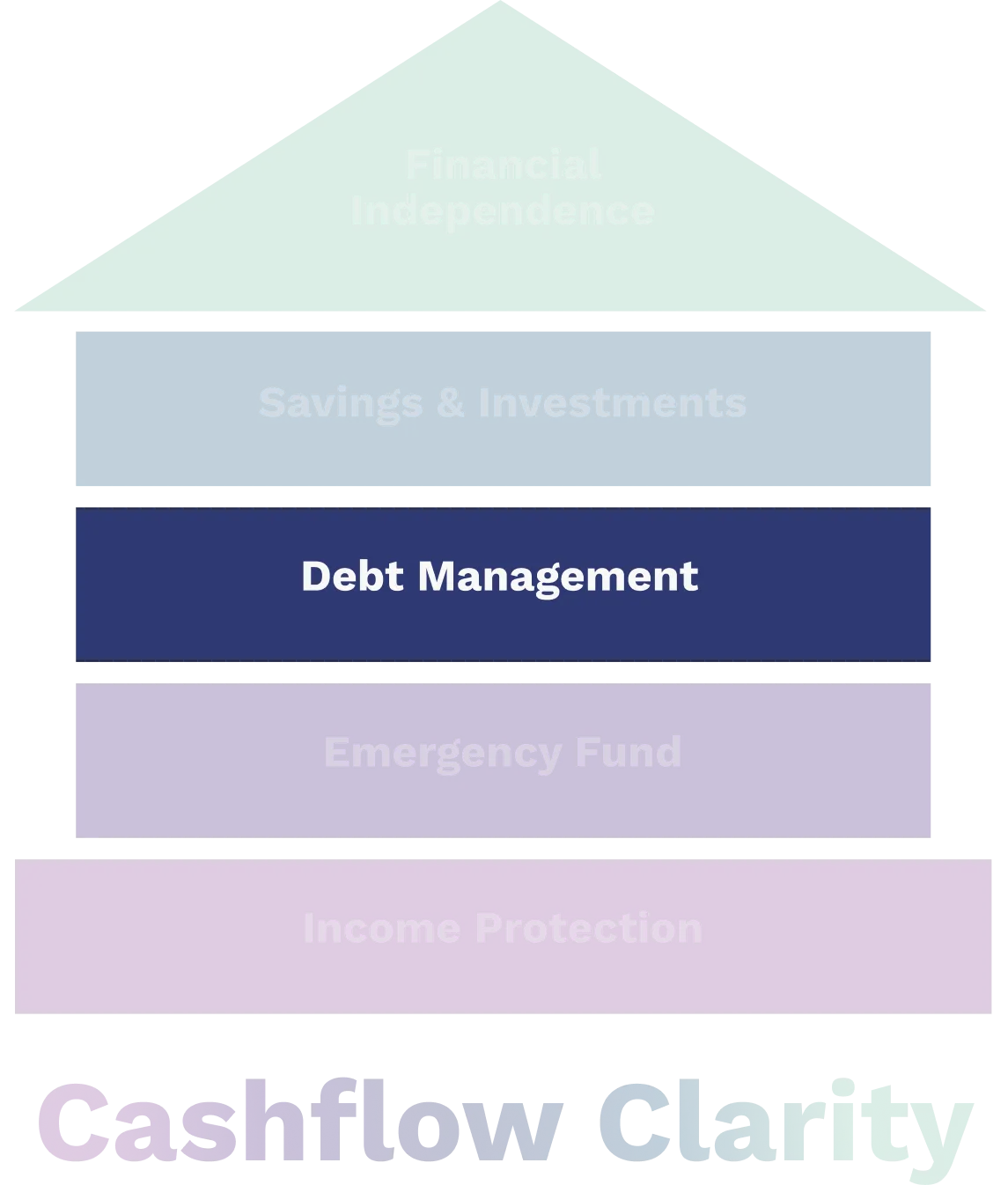

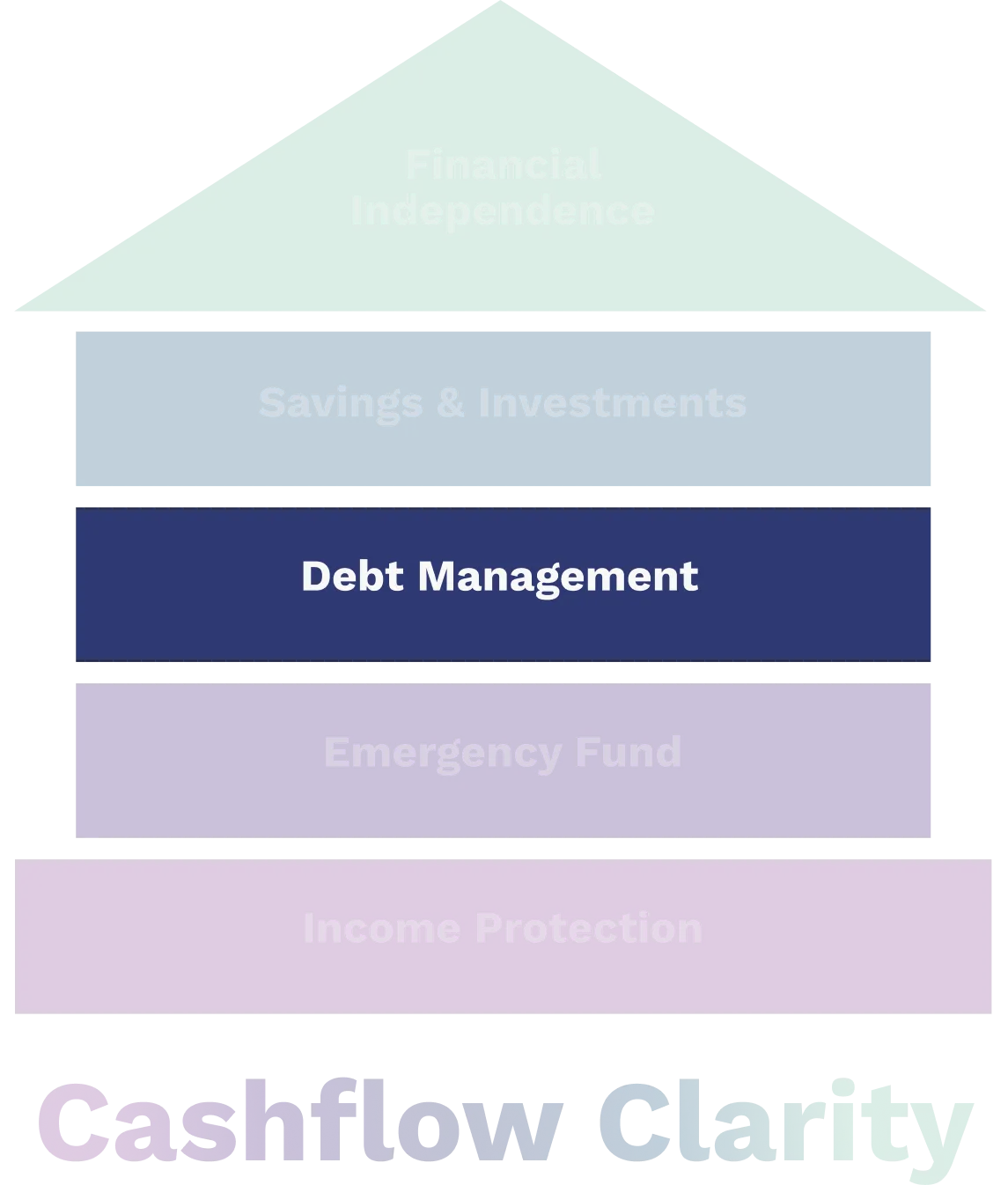

Debt Management

Debt isn’t just about interest—it’s about energy.

It drains your monthly income and your mental bandwidth.

We help you create a realistic plan to reduce debt and free up cashflow—without shame or overwhelm.

Main Floor

Saving & Investing

Saving and investing aren’t just about growing money—they’re about giving it purpose.

We help you set real goals, then create a plan to reach them in a way that fits your income, lifestyle, and values.

Whether it’s a future home, your children’s education, or simply feeling secure—your money should reflect what matters to you.

Second Floor

The Roof

Financial Independence

The peak of your financial house is freedom of choice.

It’s being able to say yes to what matters—and no to what doesn’t—because your finances aren’t in survival mode anymore.

Financial independence isn’t a number—it’s the ability to live on your terms, with clarity, confidence, and control.

step by step

Building Your Financial House

01 - The Ground

Cashflow Clarity

Before you build anything, you need solid ground.

If you don’t know where your money’s going, it will always feel like there’s “never enough.”

We help you get clear on your income, your spending, and your patterns—so you can make decisions with confidence instead of confusion.

01 - The Foundation

Income Protection

If your income stopped tomorrow, what would happen?

Your ability to earn is what everything else depends on.

We help you secure the right protection so your entire financial life doesn’t collapse from a single unexpected event.

03- The Basement

Emergency Fund

Emergencies are not “if.” They’re “when.”

When you don’t have a buffer, every curveball becomes a crisis.

We help you build a safety net that makes space for real life—without panic, guilt, or relying on borrowing and credit cards.

04 - The Main Floor

Debt Management

Debt isn’t just about interest—it’s about energy.

It drains your monthly income and your mental bandwidth.

We help you create a realistic plan to reduce debt and free up cashflow—without shame or overwhelm.

05 - The Second Floor

Saving & Investing

Saving and investing aren’t just about growing money—they’re about giving it purpose.

Whether it’s a future home, your children’s education, or simply feeling secure—your money should reflect what matters to you.

We help you set real goals, then create a plan to reach them in a way that fits your income, lifestyle, and values.

How We Help You Take Control and Build Real Financial Security

step one

Take the Financial Readiness Quiz

This isn’t about pressure—it’s about clarity.

The quiz helps you see exactly where you stand today, what’s working, and what to focus on next to build lasting security.

step two

Have a Real Conversation With a Licensed Advisor

You’ll connect with someone who gets it. Someone who listens, explains, and helps you figure out what’s working, what’s not, and what comes next—without the sales pitch.

step three

Get Your Personalized Financial Plan

Like framing a house, this is where the structure comes together. We’ll help you build a plan around your income, goals, and values—something you can actually follow, trust, and feel good about.

step Four

Implement Your Plan—One Step at a Time

You're not left to figure it out alone. Your advisor walks with you, helping you put each piece in place—protection, savings, debt, investments—in a way that feels manageable and aligned.

step five

Live Life Knowing Your House Can Hold You

This is what it’s all for—not just wealth, but stability. Peace of mind. The freedom to make decisions from a place of strength, not stress. When your financial house is solid, life opens up.

You’re not starting from scratch.

You’re just starting with clarity—and a team who cares about what you’re building.

Meet Our Team

We’re a group of parents, caregivers, and everyday people who’ve faced the same financial struggles you’re dealing with now. We’ve been where you are — juggling bills, debt, and uncertainty — and found a way forward.

Our mission is to guide families just like yours with the same care and understanding we’d want for our own. We combine real-world experience with financial know-how to create plans that fit your life, values, and goals.

When you work with us, you’re not just getting advice — you’re gaining a partner who truly understands what matters most: your family’s future.

Angela Flynn

As a dedicated financial advisor and co-owner of our family business, I work alongside my fiancé, Stefan, to create personalized plans that fit each client’s goals. I’m committed to making financial planning approachable, empowering, and tailored to real-life needs.

Stefan Pampulevski

As a lifelong Peace Country resident, I provide tailored financial plans with my fiancée, Angela. Our family business focuses on empowering clients with knowledge while making the process positive and approachable.

Carla Lummerding

As a financial broker with lived experience of disability and single motherhood, I create inclusive, transparent strategies that help families navigate life’s challenges with clarity, confidence, and dignity.

Shannon Zacharias

A life-changing accident showed me the importance of a solid plan. I create clear, personalized financial strategies that replace confusion with confidence, helping clients protect what matters most.

Tina Hunder

I help families protect their future and achieve their goals through smart, ethical financial strategies. Inspired by my own family’s need for security, I focus on planning, education, and long-term partnerships that turn aspirations into reality.

Sabina Walpole

As a mom of three, I help busy families make confident, informed financial decisions. With practical advice and a friendly approach, I make financial planning simple and stress-free.

Franciska Walsh

Based in Dawson Creek, I guide clients toward secure, confident futures. My approach is supportive, straightforward, and designed to make financial planning clear and empowering.

Chad Elderkin

After 25 years in the oilfield, I know the value of hard-earned money. Now, I help people pay off debt, protect loved ones, and invest for the future—keeping the process simple, honest, and practical.

Join our team!!